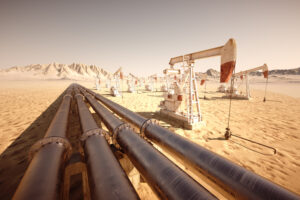

It is hoped that the Israel/Iran conflict will not be a prolonged affair, because if it is, global economies could be up shit creek without a paddle. If oil prices keep rising, we would be seeing stagflationary pressures on global economies with a drag on growth and fuelling inflation.

Since oil is a foundational input for transportation, manufacturing, agriculture, and even some forms of electricity generation, its cost reverberates across nearly every sector. When the price of crude oil rises, so too does the cost of fuel – particularly diesel and petrol – which makes it more expensive to transport goods. This includes everything from food and all those formerly cheap Chinese consumer electronics to construction materials and machinery. As a result, businesses face higher operating costs, which they typically pass on to consumers in the form of higher prices.

Cheap Chinese imports, already burdened by Trump’s high tariffs, would become even more expensive if global shipping costs rise—especially via key routes like the Red Sea or the Strait of Hormuz. In the UK, the cost of shipping and delivery of goods is already at a high level, add in VAT, import taxes, and all the other punitive Labour taxes, invariably resulting in soaring costs that will be passed on to the consumer. When the cost of transporting goods increases, those higher expenses are typically passed along the supply chain, ultimately landing on businesses and consumers in importing countries.

For Western economies heavily reliant on goods manufactured in China—everything from electronics and machinery to textiles and household items—this creates a twofold inflationary pressure: first from tariffs, which act like an import tax, and second from increased freight charges, which raise the landed cost of goods. These added costs can erode profit margins for retailers and manufacturers, who then face a choice between absorbing the losses or raising prices.

Cost of living crisis on steroids

The net result is likely a general rise in the cost of living, especially on goods that consumers interact with daily. In the UK, the cost of living crisis has already been increased by the insane, irresponsible and profligate state spending decisions of the lunatic Labour government, so oil prices will only compound the terrible decisions made by the UK government. Shoplifting is now a normalised and accepted daily occurrence in all retail and food stores, where the police ignore the crimes, and the businesses pass on the costs to the consumer.

Additionally, this kind of imported inflation can be particularly difficult for central banks to manage, as it’s driven by external supply-side shocks rather than domestic demand. If the situation persists, it could contribute further to inflationary pressures, dampen economic growth, and edge vulnerable economies closer to stagflation.

These rising costs contribute directly to inflation. People start spending less. This erodes consumers’ purchasing power. Essentials such as food, heating, and commuting become more expensive, disproportionately affecting lower and middle-income families, who spend a larger share of their income on these necessities.

Interest rate rises

Higher inflation, in turn, can prompt central banks to raise interest rates in an effort to cool the economy and stabilise prices. While this might contain inflation in the medium term, it also increases borrowing costs for households and businesses. Mortgages, credit card debt, and business loans all become more expensive, which tends to reduce spending, investment, and overall economic activity. Higher interest rates have significant ripple effects on both government finances and overall market liquidity.

For governments, rising interest rates directly increase the cost of servicing national debt. As older bonds mature and are refinanced at higher rates, the amount the government must pay in interest climbs sharply. This puts pressure on public finances, particularly in countries with large debt burdens. More money spent on debt interest means less available for public services, investment, or tax cuts, and may even force tax rises or spending cuts to balance budgets.

Loss of liquidity

In financial markets, higher interest rates reduce liquidity. As borrowing becomes more expensive, both consumers and businesses cut back on spending and investment. It also tightens credit conditions—banks lend less, and investors tend to move money into safer, interest-bearing assets like government bonds, rather than into equities or riskier ventures. This can slow down economic growth and reduce capital flow in the markets, often leading to declining asset prices and tighter financial conditions overall.

In financial markets, higher interest rates reduce liquidity. As borrowing becomes more expensive, both consumers and businesses cut back on spending and investment. It also tightens credit conditions—banks lend less, and investors tend to move money into safer, interest-bearing assets like government bonds, rather than into equities or riskier ventures. This can slow down economic growth and reduce capital flow in the markets, often leading to declining asset prices and tighter financial conditions overall.

For energy-importing countries, high oil prices worsen the balance of trade, as more money is spent on foreign energy. There goes Trump’s attempt to help U.S. imports and exports. This can weaken the national currency, making imported goods more expensive still, and further stoking inflation.

Oil exporting countries

On the other hand, oil-exporting countries may benefit from higher revenues, which can boost public spending and national income – though even in these cases, over-reliance on oil often brings long-term volatility and distortion.

The diabolical policies of the Labour government in the UK have banned companies to drill oil in the vast lucrative North Sea fields, therefore the UK will not profit from high oil prices.

Can OPEC help?

OPEC could attempt to offset rising oil prices by increasing production. By boosting supply, they could help stabilise or even lower global oil prices, but it is not certain OPEC would take this step if it does not align with their strategic and political plans. OPEC often aims to balance oil prices to maximise revenue for its member states without triggering demand destruction or encouraging rival producers, such as U.S. shale companies, to ramp up production. If prices rise modestly due to higher shipping costs, OPEC might not see an urgent need to act. But if prices spike dramatically and threaten to tip the global economy into recession, they may be more inclined to intervene, especially with an irate Trump breathing down their necks.

There’s also the issue of internal capacity and cohesion. Not all OPEC members can easily increase output due to infrastructure or budget constraints. Plus, coordination among OPEC+ (which includes Russia) isn’t always smooth, particularly when members have divergent economic needs or geopolitical interests.

Governments forced to increase taxes

Indeed, high oil prices can also lead to rising taxes, either directly or indirectly, further deepening the economic strain. As governments contend with increased public spending—on energy subsidies, inflation-linked benefits, or fuel-related infrastructure—they may need to raise additional revenue to balance their budgets. When inflation pushes up the cost of government borrowing and welfare obligations, fiscal pressure mounts, especially in countries already carrying large debts. In such cases, tax increases become a tool to plug budget deficits and maintain public services.

Indeed, high oil prices can also lead to rising taxes, either directly or indirectly, further deepening the economic strain. As governments contend with increased public spending—on energy subsidies, inflation-linked benefits, or fuel-related infrastructure—they may need to raise additional revenue to balance their budgets. When inflation pushes up the cost of government borrowing and welfare obligations, fiscal pressure mounts, especially in countries already carrying large debts. In such cases, tax increases become a tool to plug budget deficits and maintain public services.

Additionally, if oil prices depress economic growth, governments may face a fall in tax receipts from income, consumption, and corporate profits. This shortfall can prompt them to raise other taxes—such as VAT, income tax, or fuel duties—to compensate. In economies with fuel subsidies, high oil prices force governments to either raise taxes to fund those subsidies or reduce them altogether, leading to a rise in retail fuel prices and a political backlash.

Thus, high oil prices can contribute to a cycle where inflation, slowing growth, and fiscal strain feed into higher taxes, amplifying the financial burden on both households and businesses.

WTF is Stagflation?

Stagflation is a rare but damaging combination of stagnant economic growth, high inflation, and often high unemployment. It’s a paradox for policymakers because the usual tools to fight inflation—like raising interest rates or cutting spending—can further suppress growth and employment.

High oil prices can trigger stagflation by increasing the cost of production and transportation across the entire economy. When businesses face higher energy and logistics costs, they often pass these onto consumers in the form of higher prices, fuelling inflation. At the same time, these higher costs can erode business profits and reduce consumer purchasing power, which weakens demand and slows down economic growth.

As costs rise and demand falters, companies may scale back production or hiring, potentially increasing unemployment. Governments and central banks then face a grim policy dilemma: if they raise interest rates to fight inflation, they risk worsening the slowdown; if they stimulate the economy to boost growth, they risk entrenching inflation even further.

The classic example of stagflation occurred in the 1970s, when oil price shocks—largely driven by geopolitical events—caused exactly this scenario across the Western world. With today’s complex global supply chains and energy dependencies, a similar oil shock could once again tip vulnerable economies into a stagflationary trap.